As we approach the end of the year, there is still time to get valuable tax breaks related to the security of your home, home office or business. The main problem is that many people aren’t aware of these tax breaks and don’t take advantage of them.

Do you qualify for any security-related tax breaks? Let’s go over five of the most common ones and see if you qualify.

-

Car Tracking Services

Many insurance companies will offer a discount if you have a stolen vehicle recovery system installed, but you can use this to your advantage during tax season if your employer doesn’t reimburse you for it. This applies to company vehicles and vehicles you use for company purposes, such as delivering products. If it’s a professional expense that isn’t reimbursed, there’s a good chance it’s a tax break.

-

Home Office Security Improvements

Any security improvements you make to your home office can also be written off and you get more of a break if the improvements are exclusive to your home office. So if you buy and install a security camera in your home office, it’s a tax break. As would reinforcing windows in your home office or installing locks on the doors.

-

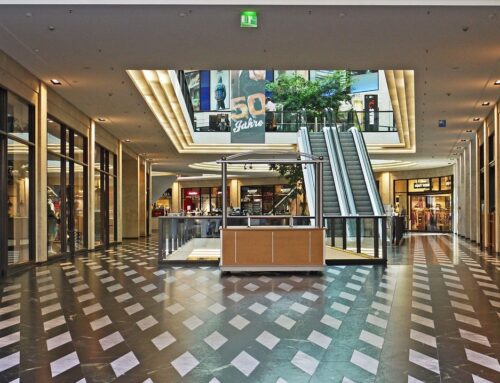

Whole-Home Security Improvements

You can also write off certain improvements to other areas of your home, if they impact the security of your entire home including your home office. For example, if your home office takes up 20 percent of the square footage of your home, you can write off 20 percent of expenses that impact the whole home. A surveillance system and new locks on the fence gate both qualify for at least a small percentage of security expenses you can write off.

-

Unreimbursed Business Expenses

If you have a security-related expense that your employer won’t cover, you can potentially write it off on your taxes. For example, if you have a business trip and you want to secure your luggage with a new lock that your employer won’t cover, it could qualify for a small tax break. Or, you could write off a portion of your internet service if you use it for monitoring a company vehicle. These unreimbursed business expenses can add up over time.

-

Unused Budgetary Considerations

Finally, while it’s not necessarily a tax break, the end of the year is a good time for making business improvements in general. Whether you own a business or lead a specific department, maximizing your budget will ensure you can expect the same amount next year. If you have room in your budget for security improvements, now is the time to make them.

We’re not CPAs and encourage you to talk with a financial advisor on your specific tax handling for security-related purchases. Whether your security improvement qualifies for a tax break or not, if you’re looking to enhance the security of your home or office, contact the team at A-1 Locksmith today.